Compound interest calculator with tax deduction

To use our calculator simply. Credit Cards Insurance.

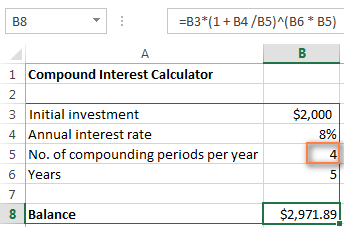

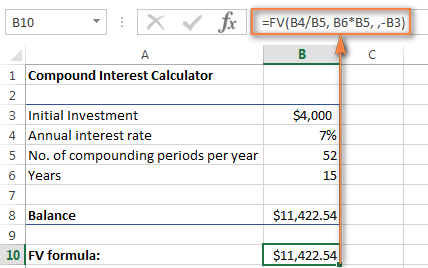

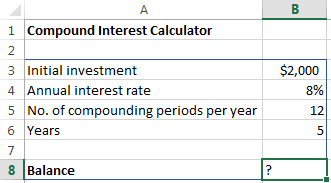

Compound Interest Formula And Calculator For Excel

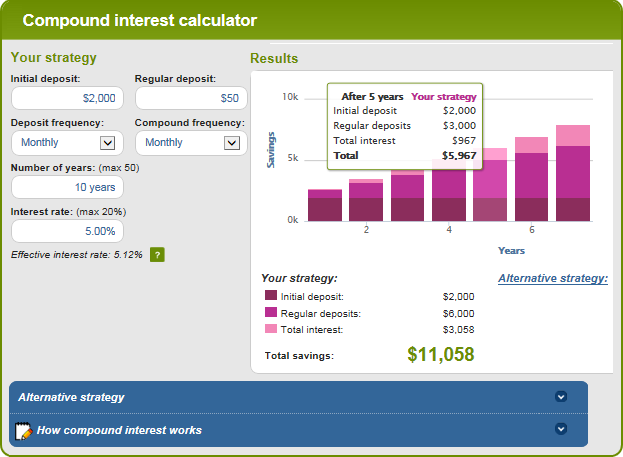

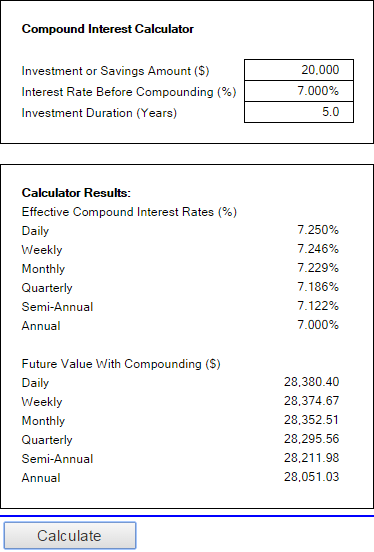

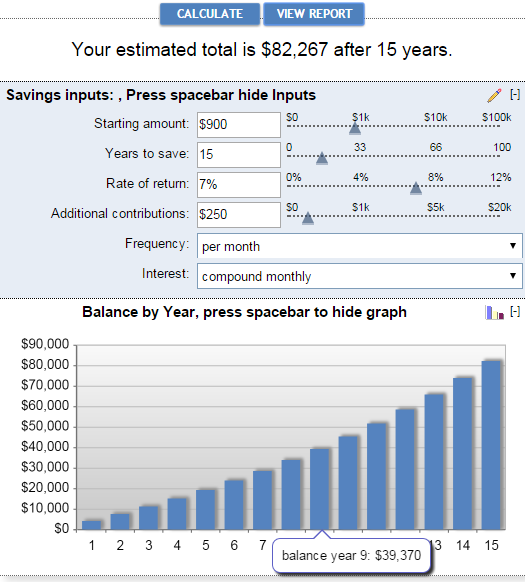

Our calculator allows the accurate calculation of simple or compound interest accumulated over a period of time.

. Earning from other sources like savings investments rent etc. Under Section 24b a deduction of Rs 2 lakh is allowed for self-occupied property and the entire interest is deductible for let out property. Deductions like municipal taxes paid actual interest on housing loan no ceiling limit for claiming interest on let out property will be allowed as deduction.

Compounded Annually Deduction on a deposit made up to Rs 15 lakh. The mortgage is a secured debt on a. CAGR Calculator - Calculate your Compound Annual Growth Rate CAGR via ClearTax CAGR Calculator.

Thought to have. You can use this EIC Calculator to calculate your Earned Income Credit based on the number of qualifying children total earned income and filing status. Compound Interest Calculator Best Savings Accounts Best CD Rates Best Banks for Checking Accounts Best Personal Loans Best Car Loans More.

The 2017 Tax Cuts and Jobs Act bill increased the standard deduction to 12000 for individuals and married people filing individually 18000 for head of household and 24000 for married couples filing jointly. Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates. To claim this deduction they should also.

The maximum deduction is limited to Rs 10000. New Dividend Calculation from the tax year 20162017 onwards. If you make 70000 a year living in the region of Oregon USA you will be taxed 15088.

Is home loan tax deductible in 2020-21. 25 lakhs as a deduction for the let out property. Deduction allowed is Rs150000 during a financial year over and above the deduction of section 24.

Principal amount- 80C deduction Interest-Tax-free. Marriage has significant financial implications for the individuals involved including its impact on taxation. The pre-construction interest deduction is allowed for interest payments made from the date of borrowing till March 31st before the financial year in which the construction is completed.

These limits have increased every year since. Further you can also file TDS returns generate Form-16 use our Tax Calculator software claim HRA check refund status and generate rent receipts for Income Tax Filing. Sales Tax Deduction Calculator Congressional Research Service.

Unit Linked Insurance Plan ULIP 5 years. Overview and Analysis Page 1. If your interest income is less than Rs 10000 the entire interest income will be your deduction.

From 6 April 2018 the Dividend Allowance reduced to 2000. Tax already paid through TDS. 1681276 for surprisingly efficient and user-friendly and free comparison of refinancing rates on both home and.

The calculator below can help estimate the financial impact of filing a joint tax return as a married couple as opposed to filing separately as singles based on 2022 federal income tax brackets and data specific to the United States. National Saving CertificateNSC 5 years. Subject to ULIP fund performance in the market.

You filed an IRS form 1040 and itemized your deductions. Transport allowance and house rents. Principal amount- 80C deduction Interest- 10 LTCG Dividend- 10 DDT.

Furthermore an additional investment of 50000 qualifies for tax deduction under Section 80CCD1B making the total deductions available to INR 2 lakhs. Interest paid on home loan is eligible for deduction of Rs2 lakh if the house property is self occupied. The investments and gains are exempt from tax.

An MMM-Recommended Bonus as of August 2021. However under Section 80EE an additional deduction of Rs 50000 is allowed only after exhausting the limit of Section 24b. The Earned Income Credit EIC is a refundable tax credit available to working individuals with low to moderate incomes.

The EIC reduces the amount of taxes owed and may also give a refund. Most BTL deductions are the run-of-the-mill variety above including several others like investment interest or tax preparation fees. Maximum Deduction Allowed Under Section 80TTA.

The investments up to 150000 qualify for tax deduction under 80CCD1 and 80CCD2 combined of the Income Tax Act. Old vs New Tax Slab Regime Calculator. Standard Deduction Allowance Amount.

Taxpayers who live in states that dont have an income tax are probably better off using their sales tax for the deduction. If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs 15 lakh each in their tax returns. Income Tax Calculator - Calculate Income Tax FY 2021-22 AY 2022-23 2022-23 2021-22 with Tax2Win Income Tax Calculator.

Using an income tax calculator you can calculate the tax liability based on the following points - 1. Here Mr X can claim actual home loan interest paid of Rs. Choose what you would like to calculate.

In 2021 the standard deduction for single filers married filing separately is 12550. Yes interest on home loan can be claimed under section 24 and 80EEA. If your interest income is more than Rs 10000 your deduction shall be limited to.

The dividend tax rates for dividends that exceed the set allowance are. This marginal tax rate means that your. Taxes are unavoidable and without planning the annual tax liability can be very uncertain.

Use this federal income tax calculator to estimate your federal tax bill and look further at the changes in 2021 to the federal. In order to use our free online IRS Interest Calculator simply enter how much tax it is that you owe without the addition of your penalties as interest is not charged on any outstanding penalties select the Due Date on which your taxes should have been paid this is typically the 15 th of April and lastly select the Payment Date the date on which you expect to pay the full. A deduction of up to 150000 from your total annual income.

Rs 90000 for FY 2018-19 and Rs 120000 for FY 2019-20 totaling to Rs 210000. In 2021 and 2022 this deduction cannot exceed 10000. Select the currency from the drop-down list this step is optional.

Please contact Savvas Learning Company for product support. Your average tax rate is 1198 and your marginal tax rate is 22. Components of income eligible for exemptions.

Annual income coming from salary and other profits. Compound interest or compounding interest is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan. Sukanya Samriddhi Yojana Calculator.

Total interest on home loan. To qualify for a home mortgage interest tax deduction homeowners must meet these two requirements.

Compound Interest Formula And Calculator For Excel

Compound Interest Formula And Calculator For Excel

Tax Shield Formula How To Calculate Tax Shield With Example

Compound Interest Formula And Calculator For Excel

Compound Interest Formula And Calculator For Excel

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Tax Shield Formula How To Calculate Tax Shield With Example

Compound Interest Formula And Calculator For Excel

Compound Interest Formula And Calculator For Excel

Compound Interest Calculator Getsmarteraboutmoney Ca

Tax Shield Formula How To Calculate Tax Shield With Example

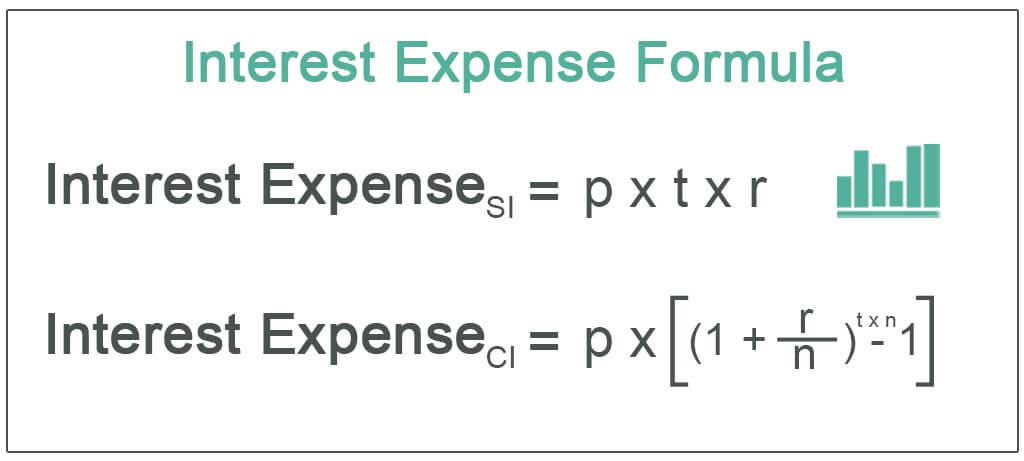

Interest Expense Formula Top 2 Calculation Methods

Interest Tax Shield Formula And Calculator Excel Template

Compound Interest Calculator Calculate Compiund Interest On Investments Tax2win

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Income Tax Calculating Formula In Excel Javatpoint

Excel Formula Income Tax Bracket Calculation Exceljet